It is a written statement by LHDN that states your taxable income amount of tax due and so on. GST Accounting Software Price.

7 Tips To File Malaysian Income Tax For Beginners

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

. See the Departments circular note dated April 10 1991. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Headquarters of Inland Revenue Board Of Malaysia.

FREE for 1st year in India refer pricing for other countries such as India Australia Malaysia Nepal Pakistan Singapore Sri. If you are employed. There are no other local state or provincial.

Check income tax slabs and tax rates in India for FY 2021-21. However foreign-sourced income of all Malaysian tax residents except for the following subject to conditions to be announced which is received in Malaysia is no longer be exempted with. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Locally hired foreign mission employees If you are permanently resident in the United States for purposes of the Vienna Conventions you are not entitled to the income tax exemption available under the Vienna Conventions. Search RinggitPlus Search Clear. No other taxes are imposed on income from petroleum operations.

For Account Statement From Registered Mobile Number ACCSTMTPOLICY NO. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. A step-by-step guide with everything you need to know about filing your income tax returns form for Malaysia income tax 2020 year of assessment 2019.

Let us understand the salary package and the incentives earned by an Income Tax. Introduction Individual Income Tax. Income Tax Calculator for AY 2023-24 FY 2022-23 AY 2022-23 FY 2021-22 AY 2021-22.

The starting salary of the SSC CGL Income Tax Inspector and Income Tax Officer is somewhere around 44900 INR along with a grade pay that ranges somewhere between 4000-5500 INR. If you disagree with the. How To Pay Your Income Tax In Malaysia.

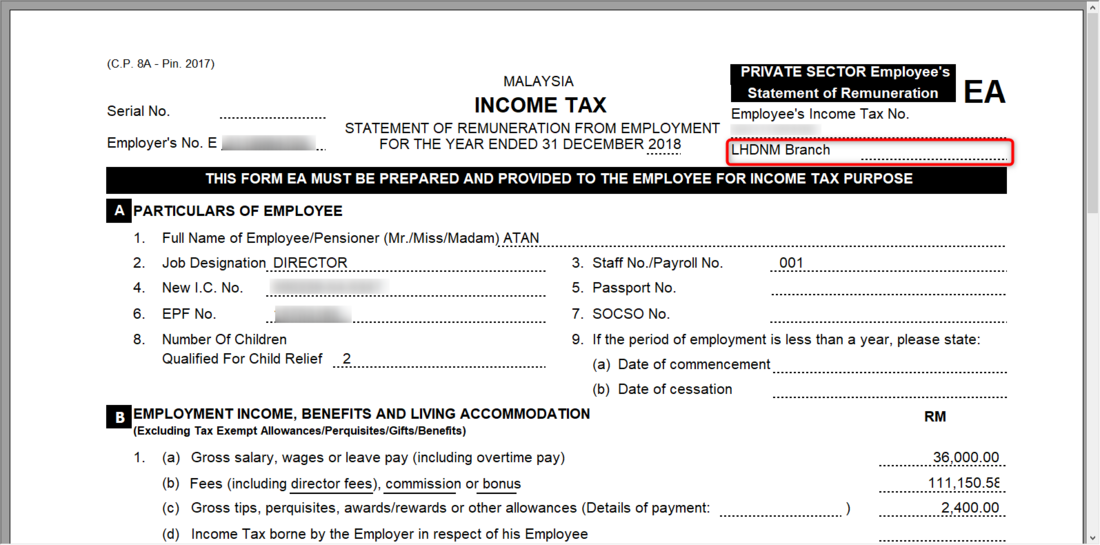

As per the grade you are selected for there can be a mild variation in the salary. About the Income Tax Annual Information Statement AIS The Income-Tax Department has released a new AIS Annual Information Statement that incorporates new categories of data such as dividends interest mutual fund transactions international remittances and securities transactions. According to Section 831A Income Tax Act 1967 that every employer shall for each year prepare and render to his employee statement of remuneration Form EA of that employee on or before the last day of February in the year immediately following the first.

Form EA is a Yearly Remuneration Statement prepared by the company to employees for tax submission. Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

Tax Offences And Penalties In Malaysia. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Income tax information for A or G visa holders.

How Does Monthly Tax Deduction Work In Malaysia. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Guide To Using LHDN e-Filing To File Your Income Tax.

Other sources of Income details. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

How To Step By Step Income Tax E Filing Guide Imoney

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

How To File Your Taxes For The First Time

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Business Income Tax Malaysia Deadlines For 2021

Payroll How To Fill In Lhdnm Branch On Income Tax Ea Autocount Resource Center

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Guide To Using Lhdn E Filing To File Your Income Tax

7 Tips To File Malaysian Income Tax For Beginners

St Partners Plt Chartered Accountants Malaysia Form Ea 2020 Statement Of Remuneration From Employment For Private Sector This Form Ea Must Be Prepared And Provided To The Employee

Personal Income Tax E Filing For First Timers In Malaysia Mypf My